Erin El Issa writes data-driven studies about personal finance, credit cards, travel, investing, banking and student loans. She loves numbers and aims to demystify data sets to help consumers improve their financial lives. Before becoming a Nerd in 2014, she worked as a tax accountant and freelance personal finance writer. Erin's work has been cited by The New York Times, CNBC, the "Today" show, Forbes and elsewhere. In her spare time, Erin reads voraciously and tries in vain to keep up with her two kids. She is based in Ypsilanti, Michigan.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Asking your credit card issuer to increase your credit limit can not only boost your buying power, but also lower your credit utilization , which could help your credit scores. Whether your request will be approved, however, is a matter of timing. It's often said that the best time to ask for new credit is when you don't need it (at least, not yet).

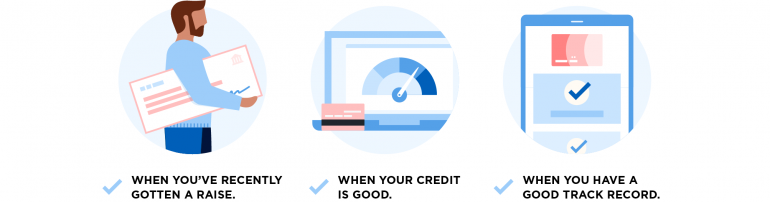

When you’ve recently gotten a raise. An increase in income means you’ll be able to cover an increase in credit card expenses. Note: You may need to provide proof of your new income to get approved for a higher credit limit.

When your credit is good. A good credit score signals to your credit card issuer that you’re responsible with borrowed money. Therefore, you’re more likely to make payments on time and understand how much you can afford to charge each month. You can track your credit score for free via personal finance websites, including NerdWallet. Remember, good credit isn’t the same thing as good financial health, but creditors assume that these qualities are linked. Aim to have both.

When you have a good track record. If you’ve made all of your payments on time and never maxed out your card, you’re more likely to get approved for a limit increase. (Late payments and high credit utilization can suggest someone having money troubles.) You’ll also have a better chance if you’ve had your account with this particular creditor for at least six months to a year.

Ready to earn your first $100 in rewards?Nerdwallet+ members can earn $100 in rewards by paying their first bill on time with one of these eligible credit cards.

GET STARTED

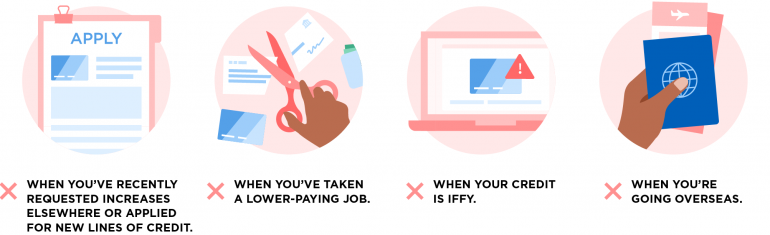

When you’ve recently requested increases elsewhere or applied for new lines of credit. A flurry of requests for new credit can be a sign of financial distress. When you apply for new credit, and sometimes when you apply for a credit limit increase, a hard inquiry appears on your credit report. New credit applications trigger a new credit penalty, which may hurt your credit, especially if the length of your credit history is short.

When you’ve taken on a lower-paying job. If you’ve recently taken on a lower-paying job, even if it's more fulfilling, this isn’t the time to ask for an increase. Your spending power has decreased, so the issuer has no reason to extend more credit to you.

When your credit is iffy. If your credit score isn’t good or excellent, it’s likely that you won’t get approved for more credit because you haven’t shown good judgment with credit in the recent past. Build up your score before making a limit increase request.

When you’re embarking on an overseas adventure. Travel feeds the soul, but it also makes you more susceptible to credit card fraud. Travel also frees our (financial) inhibitions, leading us to spend more than we normally would. By upping your limit, you’ll give yourself more leeway to run up an expensive credit card bill you’ll have to pay when you get back to reality. Wait to increase your limit until you get back.

Oftentimes, a limit increase request will trigger a hard pull on your credit report . This can hurt your credit, especially if you have a short credit history. If you call your credit card issuer, you can ask whether a hard inquiry will be initiated. Sometimes you can take a smaller increase and forgo the pull.

If you decide it’s the right time to up your limit, either call customer service or request a credit limit increase online. It’s a very simple procedure. Don’t be discouraged if your request is denied. Your credit card issuer might increase your credit limit in the future when the timing is right.

Bottom line: Try to time your credit limit increase request so it’s more likely to get approved. And, of course, try to keep your spending low enough that you can pay your credit card in full each month.

You’re following Erin El Issa

Visit your My NerdWallet Settings page to see all the writers you're following.

Erin El Issa is a credit cards expert and studies writer at NerdWallet. Her work has been featured by USA Today, U.S. News and MarketWatch. See full bio.

On a similar note.

Download the app

Disclaimer: NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. Pre-qualified offers are not binding. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

NerdUp by NerdWallet credit card: NerdWallet is not a bank. Bank services provided by Evolve Bank & Trust, member FDIC. The NerdUp by NerdWallet Credit Card is issued by Evolve Bank & Trust pursuant to a license from MasterCard International Inc.

Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations.

NerdWallet Compare, Inc. NMLS ID# 1617539

California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812

Insurance Services offered through NerdWallet Insurance Services, Inc. (CA resident license no.OK92033) Insurance Licenses

NerdWallet™ | 55 Hawthorne St. - 10th Floor, San Francisco, CA 94105