LogRocket’s Galileo AI watches every session, surfacing impactful user struggle and key behavior patterns.

There is an African proverb that says, “If you want to go fast, go alone. If you want to go far, go together.” It really struck me when I first heard it and I think it particularly resonates with building products.

For one, you can’t do anything alone! There is no product without a developer writing code, for example. And how do they know what to code without a problem definition and designs that bring it to life?

So, how do you work out who is going to help you go far together? This is where stakeholder analysis comes in. It helps you understand who you want to collaborating with throughout the product lifecycle and how best to communicate with each stakeholder group.

Stakeholder analysis refers to endeavors to identify, understand, and prioritize the various parties involved in a project.

In a nutshell, stakeholder analysis is a systematic process of mapping out the key individuals, groups, or organizations who have a vested interest in a product, assessing their needs and expectations, and determining the best strategies for managing relationships and communication with them.

In product management, stakeholder analysis and management is critical as the landscape is often fast-paced, highly competitive, and involves diverse interests. Engaging with stakeholders in a thoughtful way enables you to gain valuable insights and feedback to shape your product, build a strong ecosystem around it, and, ultimately, deliver a successful, high-impact product that meets the needs of all parties involved.

Obviously, as product managers, you are obsessing over your customers and will understand their needs well. However, there may be other stakeholders beyond your customers who need to be factored into the product design too.

The number and range of people involved with your product will vary depending on your organization’s unique goals and requirements, but the general steps involved in conducting a stakeholder analysis are as follows:

Once you have conducted a comprehensive stakeholder analysis, it’s important to keep the momentum going and continue to manage stakeholder relationships effectively throughout the product development process.

Here are some additional steps to follow after you’ve conducted your stakeholder analysis:

By diligently following these steps and continually managing stakeholder relationships, product managers can ensure that they are working effectively with all stakeholders, ultimately leading to the successful development and launch of the product.

There are several popular stakeholder analysis frameworks. Some are far more involved than others.

However, the more you are in tune with the environment that you operate in, the quicker this type of exercise can be. Though, like writing, bringing structure to that knowledge and getting it out of your head may uncover some connections you did not see before.

The three most commonly used stakeholder management frameworks are:

The salience model for stakeholder analysis assesses stakeholders based on their level of power, legitimacy, and urgency.

From this, stakeholders are categorized into seven groups:

Once you’ve categorized your stakeholders as described above, you can decide how to approach communicating and collaborating with each group.

![]()

Learn more →

The Stakeholder Circle methodology focuses on understanding stakeholder relationships and the impact stakeholders have on each other:

There are five steps to this methodology, designed to take you from identification through to how you engage and monitor the relationships with the stakeholders over time:

The Stakeholder Circle method has you create a visual representation of the stakeholders, which can be very powerful when communicating with others.

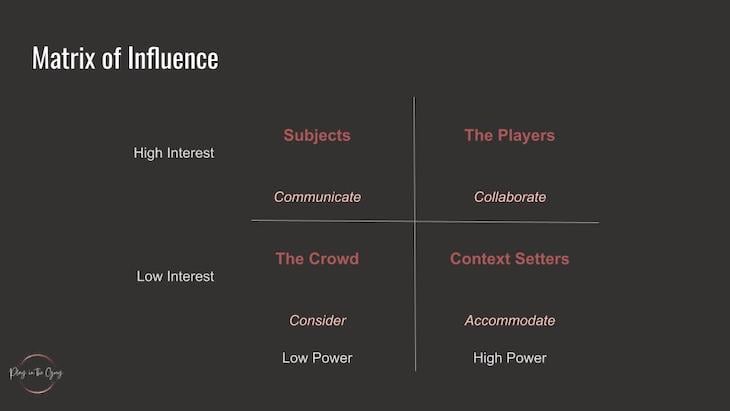

My favorite stakeholder analysis framework is the power-interest matrix, which helps identify stakeholders based on their level of power and interest in the product. It is a very simple framework that I often incorporate into kickoff sessions at the start of a discovery phase:

To use this, you identify who of your stakeholders has high or low interest in what you are building, and who has high or low power. Map the results onto a grid to categorize stakeholders into four groups:

The stakeholders in this category are important to consider even though you might not actively collaborate with them throughout the product lifecycle. Stakeholders in this category might receive widely distributed email updates on progress, for instance, or regular release notes, meeting minutes, status reports, etc.

Usually, there are people in this group who can be huge advocates for you as they have high interest in the product, but their low power means you might not want to collaborate closely on decisions impacting the product. Communicating with this group can be important to support the positive high interest they have.

The obvious example here would be regulators, who you may need to accommodate.

Laura Modi, CEO and Co-founder of Bobbie, spoke about what happened when the FDA came to visit one of her manufacturing sites of organic infant formula on Lenny’s podcast. They shut down production and Laura and her team had to work with the FDA to help them understand the approach they were taking, making some adjustments together before production could restart:

Other context setters often include senior folk in your organization.

This group of high-interest, high-power folk should be those you are spending the majority of your time with. Carefully identify who your key players are and make sure you keep them in the loop, collaborating and communicating with them each day.

What I particularly like about this framework, beyond the simplicity, is you can often find stakeholders in the “wrong” box. So, on top of finding the best ways to communicate and collaborate with each group, you might also identify the need to come up with strategies that move a stakeholder from one box to another.

Google Chrome is a great example of how stakeholder analysis can be used to create a successful product.

When Google was planning to launch Chrome in 2008, it wanted to create a browser that would compete with established browsers such as Internet Explorer and Firefox. The tech giant used stakeholder analysis to understand the needs and expectations of their target audience.

Google identified several stakeholders who could benefit from a product like Chrome, including web users, developers, advertisers, and device manufacturers. It then prioritized these stakeholders based on their level of influence and their importance to the success of the product.

Web users were identified as the most important stakeholder group, as they would be the primary users of the browser. Google conducted extensive research to understand the needs and expectations of web users, including their frustrations with existing browsers and their priorities for a new browser. The product team used this feedback to design Chrome with features that were important to users, such as speed, security, and simplicity.

Google also identified developers as an important stakeholder group because they would be responsible for creating websites that were compatible with the new browser. The product team engaged with developers throughout the development process, soliciting feedback and incorporating their suggestions into the product. It also created tools and resources to help developers optimize their websites for Chrome, which helped to increase adoption of the browser.

The last group of stakeholders Chrome’s product team identified were advertisers and device manufacturers. Google worked to ensure that the browser was compatible with a wide range of devices and platforms, which helped to increase adoption and usage of the browser. It also created advertising programs that were optimized for Chrome, which helped to drive revenue and support the ongoing development of the browser.

Ultimately, Google’s use of stakeholder analysis was a critical factor in the success of Chrome. By understanding the needs and expectations of its target audience and prioritizing stakeholders based on their level of influence, the Chrome product team was able to create a browser that met the needs of users and quickly gained market share.

It also managed to create a robust ecosystem around the browser that supported its ongoing development and growth by engaging with developers, advertisers, and device manufacturers.

Here’s a simple template you can follow when conducting and documenting a stakeholder analysis for your product:

Stakeholder analysis is a critical tool for product managers looking to deliver successful products. The frameworks can help identify your stakeholders, understand their needs and expectations, and plan activities to manage relationships effectively.

By understanding your stakeholders and engaging them in the product development process in the right way, you can create products that make a huge impact, even beyond your customers.

You might be able to move faster on your own, but you won’t go very far without the involvement and input of the stakeholders who depend on your product most.

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.